The consensus among financial analysts and industry experts is that while a total market collapse akin to the 2000 dot-com crash is unlikely, a significant correction and consolidation phase is expected between late 2025 and 2026. Unlike the speculative startups of the late 90s, today’s AI boom is driven by highly profitable tech giants with massive cash reserves. However, a “revenue gap” of over $600 billion – the difference between the money spent on AI infrastructure and the actual revenue generated from it – suggests that investor patience is wearing thin. Expect a “deflation” of hype rather than a sudden explosion, where unprofitable startups vanish, valuations normalize, and the market pivots from “what can AI do?” to “what is AI actually earning?”

The Current Landscape: Hype vs. Revenue Reality

To understand when the AI bubble will pop, we must first look at the economics driving the current frenzy. The industry is currently in a phase Gartner describes as the “Trough of Disillusionment.”

The core issue is the Capital Expenditure (CapEx) vs. Revenue Gap. Tech giants (Microsoft, Google, Meta, Amazon) are spending hundreds of billions on NVIDIA chips and data centers. The assumption is that this infrastructure will be rented out to developers who will create profitable software.

However, reports from Sequoia Capital highlight a mathematical problem: The industry is spending roughly $1 trillion on infrastructure, but the actual revenue returned to these companies is a fraction of that. David Cahn of Sequoia famously dubbed this the “$600 Billion Question,” noting that the revenue required to justify current AI infrastructure build-outs does not yet exist.

Key Statistics: The Warning Signs

| Metric | Statistic | Source/Context |

| Infrastructure Spend | $1 Trillion+ | Estimated global spend on AI CapEx over the next few years. |

| Revenue Gap | $600 Billion+ | The gap between infrastructure costs and current AI revenue (Sequoia). |

| CEO Sentiment | < 30% | Percentage of CEOs satisfied with their AI ROI (Gartner). |

| Market Concentration | High | A massive portion of S&P 500 gains are driven by just 5-6 AI-linked stocks. |

| Energy Impact | 10x | AI queries cost 10x more energy than standard search, threatening profit margins. |

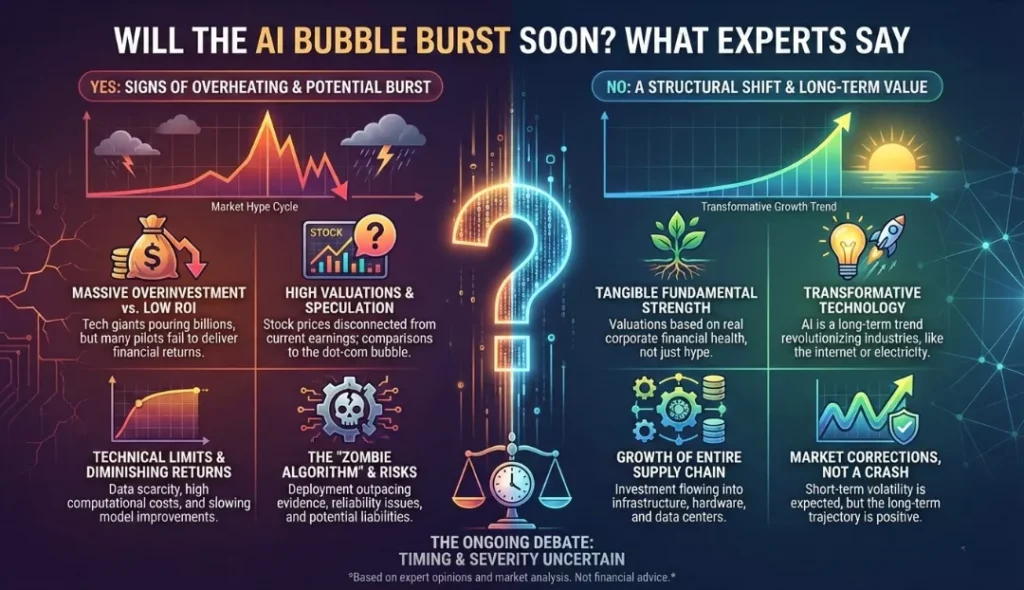

The Bear Case: Why the Bubble Might Burst

Skeptics argue that the technology, while impressive, is too expensive to be viable for widespread business automation.

1. The “Killer App” Problem

Goldman Sachs’ Head of Global Equity Research, Jim Covello, has been one of the most vocal bears. His argument is simple: When companies realize they are spending billions to automate tasks that could be done by humans for much cheaper. Covello notes that unlike the internet, which lowered costs immediately (e.g., email vs. postage), AI is currently increasing costs for many enterprises due to high compute prices.

2. The Energy Wall

AI data centers are putting unprecedented strain on power grids. Utilities cannot build power plants fast enough to meet the demand of the newest GPU clusters. This physical constraint could force a cap on growth, popping the valuation bubble as infinite scaling becomes impossible.

3. Diminishing Returns

As models get larger, they require exponentially more data and power for incrementally smaller gains in intelligence. If GPT-5 or similar next-gen models do not offer a “god-like” leap in capability, the trillions invested in training them may be viewed as wasted capital.

The Bull Case: Why This Time is Different

Despite the warnings, many experts argue against a catastrophic pop.

- Cash-Rich Giants: In 2000, dot-com companies had no profit. Today, the companies building AI (Microsoft, Apple, Google) are the most profitable machines in history. They can absorb losses for years without going bankrupt.

- Real Utility: Unlike “Pets.com,” AI tools like GitHub Copilot and Midjourney are being used by millions of professionals daily. The utility is real; the valuation is just debated.

- Agentic AI: Bulls believe we are moving from “Chatbots” to “Agents“—software that can perform multi-step actions (e.g., “book me a flight and add it to my calendar”). This shift could finally unlock the massive revenue needed to close the gap.

Timeline: When Will the AI Bubble Burst?

Experts have different timelines for when the market will correct.

Predictions at a Glance

| Expert / Firm | Prediction Timeline | Verdict | Key Reasoning |

| Capital Economics | 2026 | Burst | High interest rates + inflation will finally weigh down lofty tech valuations. |

| Gartner | 2025-2026 | Correction | Generative AI is entering the “Trough of Disillusionment.” Hype fades; engineering begins. |

| Goldman Sachs (Covello) | 12-18 Months | Skeptical | If no “killer app” emerges to justify $1T spend, stocks will re-rate downwards. |

| Stanford HAI | 2026 | Sobering | A shift from “evangelism” to “evaluation.” Companies will cut useless AI projects. |

The 2026 Danger Zone:

Most forecasts point to 2026 as the critical year. By then, the “experimental” budgets of 2023-2024 will have run dry. CFOs will demand hard numbers. If the AI implementations haven’t shown a clear profit by 2026, corporate spending will freeze, causing a chain reaction of stock sell-offs.

What Will Happen When the AI Bubble Bursts?

The core premise here is historical rhyme: Bubbles don’t just destroy wealth; they redistribute reality. When the “AI Casino” closes, we will be left with a messy cleanup, but also the building blocks for the future.

Here is how the burst will play out, translated from economic theory into real-world impact.

1. The Great Cull: The Extinction of the “Wrapper” Class

Currently, the startup ecosystem is flooded with companies that are essentially “renting” intelligence. They call themselves AI companies, but they are just pretty user interfaces (wrappers) slapped on top of OpenAI or Anthropic’s APIs.

- The Reality Check: When the bubble bursts, funding stops being about “who has the coolest demo” and returns to “who makes a profit.”

- The Wipeout: Companies that lack a “Moat” (proprietary data or unique technology) will vanish overnight. If their entire business model relies on paying a subscription to a larger AI model, they have no defense.

- The Survivor: The startups that survive will be the “Vertical AI” specialists—those that spent this time gathering messy, hard-to-get data (like proprietary legal records or rare medical imaging) that GPT-4 can’t access on the open web.

2. The $3 Trillion Domino Effect (Stock Market Shock)

We are currently in a market that is “top-heavy.” A massive portion of the S&P 500’s growth is driven by just a handful of companies (The Magnificent Seven), largely due to their AI narratives.

- The “ETF Trap”: Most people passively invest in index funds. Because Nvidia, Microsoft, and Google make up such a huge percentage of those indexes, a crash in AI stocks isn’t just a tech problem—it’s a retirement account problem.

- The Valuation Reset: Right now, these companies are priced for perfection (assuming exponential growth forever). When they announce that AI profitability is taking longer than expected, the stock prices will correct to reality. This could trigger a broader recession as liquidity dries up across the board.

3. The “Fiber Optic” Effect: The Infrastructure Inheritance

This is the silver lining, and historically the most exciting phase. During the Dot-Com boom (1998-2000), investors burned billions laying fiber optic cables across oceans. All those companies went bankrupt, but the cables stayed.

- The Post-Bubble Gift: Those “free” cables made the modern internet (Netflix, YouTube, Facebook) possible because bandwidth became dirt cheap.

- The AI Parallel: Today, we are building massive data centers and hoarding millions of GPUs. When the bubble bursts, that hardware doesn’t evaporate.

- The Innovation Boom: The cost of compute will crash. Suddenly, high-end AI training won’t be reserved for Big Tech; it will be affordable for universities, non-profits, and quirky innovators. The real useful AI apps will likely be invented after the crash, using the cheap hardware left behind by the failed giants.

4. The Labor Market Shift: From “Magic” to “Manuals”

The narrative will shift from “AI is a god that will replace us all” to “AI is a complex tool that keeps breaking.”

- The End of “Growth at All Costs”: Tech companies will stop hoarding talent. The era of the $500k salary for vague “AI strategy” roles will end. Layoffs will target experimental divisions that aren’t generating cash.

- The Integration Reality: Companies will realize that AI isn’t a “plug-and-play” solution. It requires cleaning data, fixing hallucinations, and integrating with legacy systems.

- The New Job Security: The fear of total replacement will subside. Instead, the job market will prize “AI Pragmatists”—people who know how to actually implement AI to fix boring, specific problems, rather than people who just hype up its potential.

Conclusion: A Necessary Correction

The “AI Bubble” is not a myth, but it is also not a death sentence for the technology. The market is currently pricing in perfection, assuming that AI will revolutionize the global economy instantly. The reality is that this revolution will likely take a decade, not a year.

The likely scenario is not a “pop” that destroys the industry, but a “hiss” – a slow, painful deflation of valuations throughout 2026 as the market adjusts to a realistic growth curve. For investors and businesses, the message is clear: stop buying the hype and start measuring the returns.